Tax brackets 2020 calculator

Use your income filing status deductions credits to accurately estimate the taxes. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax.

. The tax bracket calculator is one of many FlyFin features geared specifically toward freelancers and the self-employed. It can be used for the 201314 to 202122 income years. There are seven federal tax brackets for the 2021 tax year.

18 cents per gallon of regular. In other words your income determines the bracket you will be. Proven Easy Tax Solutions for Your Business.

10 12 22 24 32 35 and 37. Easily manage tax compliance for the most complex states product types and scenarios. Easily manage tax compliance for the most complex states product types and scenarios.

Effective tax rate 172. The AI-powered tax engine finds every possible tax deduction to. It is mainly intended for residents of the US.

2020 Marginal Tax Rates Calculator. 062 average effective rate. 2020 Tax Brackets Due April 15 2021 Tax rate Single filers Married filing jointly Married filing separately Head of household.

As your income exceeds a bracket the next portion of income is taxed at the next bracket and so on. There are seven tax brackets for most ordinary income for the 2020 tax year. 10 12 22 24 32 35 and 37.

And is based on the tax brackets of 2021 and. Figure out the amount of taxes you owe or your refund using our 2020 Tax Calculator. Ad Accurately file and remit the sales tax you collect in all jurisdictions.

A tax bracket is a category used to define your highest possible tax rate based on your filing status and taxable income. Ad Get the benefit of tax research and calculation experts with Avalara AvaTax software. This is 0 of your total income of 0.

Arizona State Tax Quick Facts. The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. Its never been easier to calculate how much you may get back or owe with our tax estimator tool.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. 0 would also be your average tax rate. Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

Learn More Get Started Today. Roll Over Into A TIAA Traditional IRA Get A Clearer View of Your Financial Picture. Your tax bracket is.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Use our US Tax Brackets Calculator in order to discover both your tax liability and your tax rates for the current tax season. Your bracket depends on your taxable income and filing status.

Ad Explore Our Trusted Software Services to Find the Best Fit For Your Tax Needs. Bentle K Berlin J and. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4.

Your income is taxed at a fixed rate for all income within certain brackets. 2020 Deductions and Exemptions Single Married Filing Jointly. Estimate your tax refund with HR Blocks free income tax calculator.

Your Federal taxes are estimated at 0. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. Based on your projected tax withholding for.

2020 Simple Federal Tax Calculator. Ad Accurately file and remit the sales tax you collect in all jurisdictions. Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

The new 2018 tax brackets are 10 12 22 24 32 35 and 37. This calculator helps you to calculate the tax you owe on your taxable income for the full income year. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

Your tax bracket depends on your taxable income and your. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Ad You Can Manage Your Own IRA or TIAAs Investment Professionals Can Help You.

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

How To Calculate Federal Income Tax

Inkwiry Federal Income Tax Brackets

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

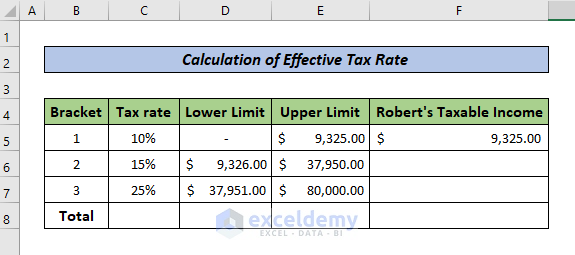

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Calculator Estimate Your Income Tax For 2022 Free

Income Tax Calculator 2021 2022 Estimate Return Refund

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

How To Calculate Federal Tax Rate In Excel With Easy Steps

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Income Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return